Life Insurance in and around Latham

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

Can you guess the price of a typical funeral? Most people aren't aware that the typical cost of a funeral today is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If your loved ones cannot come up with that much money, they may fall on hard times as a result of your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it pays off debts, maintains a current standard of living or keeps paying for your home, the life insurance you choose can be there when it’s needed most by your loved ones.

Get insured for what matters to you

Don't delay your search for Life insurance

Agent Shannon Barr, At Your Service

Some of your options with State Farm include level or flexible payments with coverage designed to last a lifetime or coverage for a specific number of years. But these options aren't the only reason to choose State Farm. Agent Shannon Barr's compassionate customer service is what makes Shannon Barr a great asset in helping you opt for the right policy.

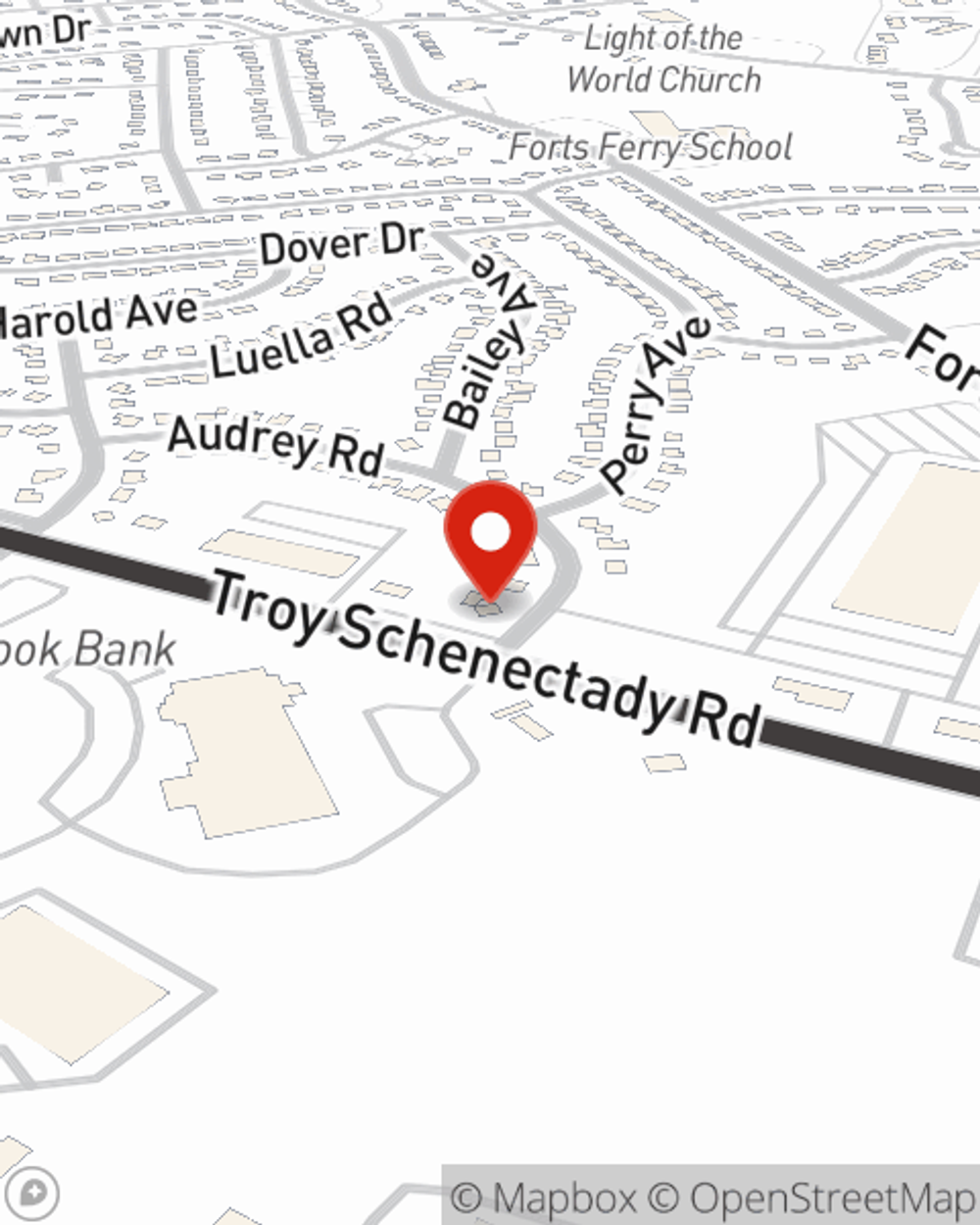

Simply call or email State Farm agent Shannon Barr's office today to check out how a State Farm policy can help protect your loved ones.

Have More Questions About Life Insurance?

Call Shannon at (518) 373-2277 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Shannon Barr

State Farm® Insurance AgentSimple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.